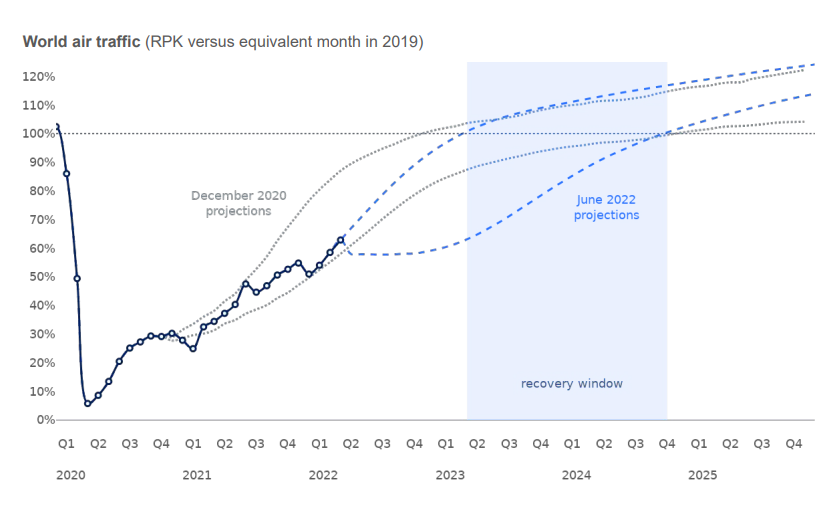

A lot was already written about the effect that pandemic years had over Aviation Sector, and how Aeronautical Industry was strongly hit. By 2019, although some airliners were struggling with profit issues and Boeing was suffering with its B737 MAX problems, we were facing a continuous and steady growth of the sector, driven mostly by low fuel prices and by the favourable economic conditions. Covid-19 brought a dramatic drop in demand for passenger air transport, and with it an unprecedented crisis, never seen not even after the 9-11 attacks. First forecasts indicated an early recovery, but we are now aware that probably we won’t be reaching air traffic previous levels until 2025.

IATA:

Nevertheless, what we are clearly facing in this pandemic outcome is a redesign of our way of travelling and flying, and new Aviation Market rules. In commercial aviation, narrow bodies are reinforcing they already strong position while wide bodies are not so demanded as in pre-pandemic years, Cargo Market is bigger than ever due to e-commerce increase, and Urban Air Mobility is shaping very quickly, with several new OEMs such as Archer, Vertical or Lilium trying to win they time-to-market race.

But one of the interesting effects is related to Business Jets Market recovery.

Most important actors in Corporative flight manufacture are Textron that agglutinates Cessna, Beechcraft and Hawker aircrafts, followed by Bombardier, Gulfstream, Dassault and Embraer. Developed from the 50’s, initially from governmental need for corporative air transport, these platforms are classified from Very Light Jets (VLJ) as the Cirrus Vision Jet with 7 PAX and 1,400lb of payload, Light Jets such as the Phenom 300E, Mid-size Jets, Super Mid-size Jets (Challenger 300) and Large jets (Dassault Falcon 900), varying in PAX capacity, range, cabin size, payload and price.

Since Covid -19 commercial travel restrictions and bans, together with the health, safety and privacy concerns of a wealth group of Businessmen are leading to an important increase in demand of Business Jets.

These are not the only factors contributing for Business Jets Market growth, especially for new buyers; there is also a lack of second hand aircrafts available, and OEMs are making an important effort in technology and sustainability that make their new jets very attractive.

And while more than the half of the business jet fleet is owned by North America, it seems that Europe, being the second most important market is now increasing its fleet in a very interesting way.

During this year’s EBACE (European Business Aviation Convention) in Geneva, Bombardier, Dassault and Gulfstream presented their new models Global 8000, Falcon 6X and Gulfstream G700 respectively, as a symptom of the positive situation of the Business Market.

In the case of Embraer, to whom Aernnova has a strong business relation with, Business Market is now stronger than ever, as Michael Amalfitano, Embraer Executive Jets CEO, said to The Weekly of Business Aviation. In 2021 Embraer delivered 93 business jets, in 2022 is expected to deliver from 100 to 110, and currently is selling aircrafts that will be delivered in 2024. Special highlights on their models Phenom 300E and Praetor that are being quite successful.

Nevertheless, one of the main obstacles for this market recovery is the capacity of the supply chain. New buyers expect to receive their aircrafts as soon as possible, and that depends if the Supply Chain can keep up with the demand. Although OEM’s policy is now based on an early engagement of the Buyer, by participating in the Jet Customization and by knowing its customer service and support, while waiting for the aircraft to be delivered, there is a delicate balance between rate increase, quality and cost. Apart from that, Supply chain worldwide was affected by pandemic and current Ukrainian war also complicates the situation, being some suppliers at finantial risk.

But how this new scenario does affects our Company? Aernnova is increasing its participation in this sector with contracts such as: Pilatus PC-24 wing design, Cessna repairs by Aernova Aircraft Services or Praetor 500 & 600 HTP and VTP composite spars manufactured at COASA, among others.

But mostly, with the new plant acquisition in Évora, Portugal, in which we perform Embraer Praetor 500 & 600 Full wing & sub-assembly components, HTP and VTP, Tailcone, Spoiler, Aileron and cargo Door we have more than ever an important industrial activity within Business Jets Market.

In this sense, we are not only seeing the market recovery in terms of new contracts or by Évora Praetor assembly line demand, increasing rates and supply chain management challenges, but we have also an important role in supporting our OEMs. Our performance, together with the rest of Tier 1 and 2 suppliers, will define in great manner the speed and range of this recovery.

I would like to end this article by saying that, although this is a very promising growth scenario, with its challenges, lately we are also seeing some head winds in the business aviation market. Recently, in a world of Instagram, influencers, followers and climate emergency, people worldwide are tracking private flights of famous individuals such as Taylor Swift or Bernard Arnault (CEO of LVMH, a luxury company), and increasing the society negative opinion on business jets. France, as a very important country visited by private jets, is already proposing its regulation and taxes, pushing European Union to include a plan for it in its October agenda. Some environmental groups are even asking for a total ban of private jet flights. Although business aviation has a low contribution to global carbon emissions, in an era when common people are constantly asked to save energy, it sounds like if climate emergency is not relevant for the wealthy ones. But the truth is that the innovation in sustainable technologies somehow could be partially funded by these rich private jet owners, before being scaled to bigger and commercial aircrafts. Let’s hope society, sustainability and business market can find a balance to go on.